Unlock the power of mutual fund investment return calculator with our detailed guide. Learn how to use mutual funds calculator effectively to analyze returns, plan investments, and optimize your portfolio for financial success.

Table of Contents

Introduction:

Mutual fund investment return calculators are powerful tools that allow investors to assess the potential returns on their investments, plan for future goals, and make informed decisions. In this comprehensive guide, we’ll delve into the world of mutual funds calculate, exploring how they work, the benefits they offer, and how to use them effectively. Whether you’re a seasoned investor or just starting out, understanding mutual funds calculate can help you maximize returns and achieve your financial objectives.

Understanding Mutual Funds Calculator:

Mutual funds calculator is a tool designed to help investors estimate the potential returns on their mutual fund investments over time. These calculators use various inputs such as investment amount, expected rate of return, investment duration, and additional contributions to calculate the future value of investments. Understanding how mutual funds calculate works is essential for investors to make accurate projections and informed decisions about their investment strategy.

Benefits of Mutual Funds Calculator:

Discover the myriad benefits of Mutual Funds Calculator with our comprehensive guide. Learn how this powerful tool can aid in financial planning, decision-making, and optimizing your investment strategy for maximum returns.

Mutual Funds Calculator stands as a beacon of empowerment for investors, offering invaluable insights and projections to guide investment decisions. In this comprehensive exploration, we delve into the myriad benefits of Mutual Funds Calculator, understanding how it facilitates financial planning, aids in decision-making, and empowers investors to optimize their investment strategy effectively.

mutual funds calculate offers a plethora of benefits to investors, making it an indispensable tool in their financial toolkit. Let’s delve into some of the key advantages it brings to the table:

Accurate Projections: mutual funds calculate provides investors with accurate projections of potential returns based on user-defined parameters. By inputting variables such as initial investment amount, expected rate of return, and investment duration, investors can obtain precise estimates of the future value of their investments.

Financial Planning: One of the primary benefits of Mutual Funds Calculator is its ability to facilitate financial planning. By projecting potential returns over time, investors can set realistic financial goals and develop a roadmap to achieve them. Whether it’s saving for retirement, funding a child’s education, or buying a house, mutual funds calculate helps investors plan effectively for their future financial needs.

Comparison of Investment Scenarios: Mutual Funds Calculator allows investors to compare different investment scenarios and evaluate their impact on investment returns. Whether it’s analyzing the returns of lump sum investments versus SIP (Systematic Investment Plan), or assessing the impact of varying investment durations, the calculator enables investors to make informed decisions about their investment strategy.

Risk Assessment: Mutual funds calculate aids investors in assessing the risk associated with their investment decisions. By inputting variables such as expected rate of return and investment duration, investors can evaluate the risk-return tradeoff of different investment options. This enables investors to make informed decisions that align with their risk tolerance and investment objectives.

Ease of Use: Mutual funds calculate is designed to be user-friendly and accessible to investors of all levels of experience. With intuitive interfaces and straightforward inputs, investors can easily navigate the calculator and obtain the information they need to make informed decisions about their investment strategy.

Empowerment Through Knowledge: Ultimately, the greatest benefit of Mutual Funds Calculator is the empowerment it brings to investors through knowledge. By providing accurate projections, facilitating financial planning, and aiding in decision-making, the calculator empowers investors to take control of their financial future and work towards their long-term goals with confidence.

Mutual funds calculate stands as a beacon of empowerment for investors, offering invaluable insights and projections to guide investment decisions. By accurately projecting potential returns, facilitating financial planning, enabling comparison of investment scenarios, assessing risk, and providing ease of use, the calculator empowers investors to optimize their investment strategy effectively. With Mutual Funds Calculator by their side, investors can navigate the complexities of investing with confidence and work towards achieving their financial goals with clarity and precision.

How to Use Mutual Funds Calculator:

Unlock the full potential of Mutual Funds Calculator with our detailed guide. Learn how to leverage this powerful tool effectively to analyze returns, plan investments, and optimize your portfolio for financial success.

Mutual Funds Calculator serves as a guiding light for investors, offering insights into potential returns and aiding in decision-making processes. In this comprehensive guide, we’ll delve into the intricacies of using Mutual Funds Calculator, providing a step-by-step walkthrough to help you maximize its benefits. Whether you’re a novice or an experienced investor, mastering Mutual Funds Calculator can unlock opportunities to achieve your financial goals with precision and confidence.

Utilizing Mutual Funds Calculator effectively requires a systematic approach. Let’s break down the process into actionable steps:

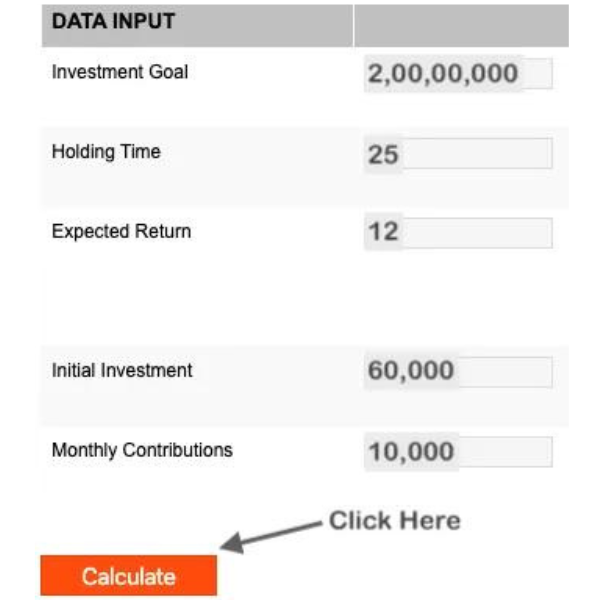

Step 1: Identify Your Investment Parameters: Before using Mutual Funds Calculator, it’s essential to identify the key parameters that will drive your investment projections. These parameters typically include:

- Initial Investment Amount: The amount of money you intend to invest initially.

- Expected Rate of Return: The average annual return you expect to earn on your investment.

- Investment Duration: The time period over which you plan to hold your investment.

- Additional Contributions: Any additional contributions you plan to make to your investment over time.

Step 2: Access a Reliable Mutual Funds Calculator: Next, access a reliable Mutual Funds Calculator from a reputable financial website or investment platform. Ensure that the calculator allows you to input the parameters mentioned above and generates accurate projections based on your inputs.

Step 3: Input Your Investment Parameters: Once you’ve accessed the Mutual Funds Calculator, input your investment parameters into the respective fields. Be sure to enter accurate information to obtain precise projections. Input your initial investment amount, expected rate of return, investment duration, and any additional contributions you plan to make.

Step 4: Review the Projections: After inputting your investment parameters, review the projections generated by the Mutual Funds Calculator. The calculator will typically provide estimates of the future value of your investments based on the parameters you’ve entered. Take note of the projected returns over different time horizons and assess how they align with your financial goals.

Step 5: Analyze Different Investment Scenarios: Mutual Funds Calculator allows you to analyze different investment scenarios by adjusting various parameters. Experiment with different combinations of initial investment amounts, expected rates of return, and investment durations to see how they impact your investment returns. This will help you make informed decisions about your investment strategy.

Analyzing Investment Returns:

Mutual funds calculator allows investors to analyze investment returns under different scenarios and make informed decisions about their investment strategy. By inputting different variables such as investment amount, expected rate of return, and investment duration, investors can compare the potential returns of different investment options and choose the one that best aligns with their financial goals and risk tolerance. Additionally, mutual funds calculator can help investors assess the impact of factors such as inflation, taxes, and fees on investment returns, allowing them to make adjustments to optimize their portfolio for maximum returns.

Planning for Future Goals:

One of the key benefits of mutual funds calculator is its ability to help investors plan for future financial goals. Whether it’s saving for retirement, buying a house, or funding a child’s education, mutual funds calculator can provide investors with a clear understanding of how much they need to invest and for how long to achieve their goals. By inputting the desired future value of investments and the investment duration, investors can determine the required investment amount and contribution frequency to reach their goals. This allows investors to create a personalized investment plan tailored to their specific objectives and timeline.

Optimizing Portfolio for Maximum Returns:

Mutual funds calculator can help investors optimize their portfolio for maximum returns by analyzing different investment scenarios and adjusting variables to achieve the desired outcome. By inputting variables such as asset allocation, expected rate of return, and investment duration, investors can assess the potential returns of different investment strategies and make informed decisions about their portfolio allocation. Additionally, mutual funds calculator can help investors rebalance their portfolio periodically to maintain their desired asset allocation and adjust to changing market conditions. This ensures that investors are able to maximize returns while managing risk effectively over time.

Conclusion:

Mutual funds calculator is a valuable tool for investors looking to maximize returns and achieve their financial goals. By understanding how mutual funds calculator works, the benefits it offers, and how to use it effectively, investors can make informed decisions about their investment strategy and optimize their portfolio for maximum returns. Whether it’s analyzing investment returns, planning for future goals, or optimizing portfolio allocation, mutual funds calculator can help investors navigate the complexities of investing and work towards financial success. With the right tools and knowledge, investors can unlock the full potential of mutual fund investments and achieve their long-term financial objectives.